On the Rachel Maddow show on January 14, Hillary Clinton tried to defend her attacking Bernie Sanders for running a so-called “negative ad” about Wall Street, and what Bernie sees as two different attitudes towards Wall Street that exist within the Democratic Party. In her interview with Rachel, Hillary says the following:

“So, what I think people reacted to is that it was a very broad assertion that caught up all Democrats. I mean, basically, it`s also a very direct criticism of President Obama, who you may recall took a lot of funding from the financial industry when he ran in 2008. That didn’t stop him for fighting for the hardest regulations on Wall Street since the Great Depression, signing Dodd/Frank, getting everything he could get out of the Congress at the time.

So, there is a difference. I think that, you know, the president and many Democrats who support Dodd/Frank, we are fighting to prevent it from being turned back and eviscerated by the Republicans, you know, are saying, wait a minute, this is hard work. And what the president got done and what the Democrats who stood with him got done is a pretty important accomplishment if we`re going to rein in the excesses on Wall Street.”

Firstly, Bernie is not talking about “all Democrats.” He is referring to the Democratic Leadership Council and the New Democrat Coalition, the “corporatist” Democratic Establishment who have been the tools of Wall Street for the past 35 years. And in doing this he is most definitely referring to Bill Clinton, Hillary Clinton and yes, even Barack Obama.

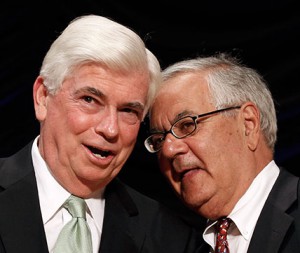

Secondly, Dodd-Frank does not go nearly far enough in regulating Wall Street. Chris Dodd (my own former Senator) was the very embodiment of a corrupt Wall Street dominated political class. He was in bed with Angelo Mozilo of Countrywide and got sweetheart mortgage loans from Countrywide as part of the “Friends of Angelo” program.

Secondly, Dodd-Frank does not go nearly far enough in regulating Wall Street. Chris Dodd (my own former Senator) was the very embodiment of a corrupt Wall Street dominated political class. He was in bed with Angelo Mozilo of Countrywide and got sweetheart mortgage loans from Countrywide as part of the “Friends of Angelo” program.

Barney Frank, for his part, has joined the revolving door club and has now taken a lucrative position on the Board of a $29 Billion Wall Street bank.

But forget Dodd-Frank. Let’s look at Obama and what he did and did not do. Obviously, Obama signed the Dodd-Frank bill. Good for him, but Presidents do not make laws. They DO have the SEC, and under Obama the SEC has been toothless and weak, as expressed in a letter of outrage by Sen. Elizabeth Warren to Mary Jo White, Obama’s choice to head up the SEC. According to an article in The New Republic entitled Democrats Are Fed Up with the SEC’s Weak Financial Crimefighting:

“Enforcement, where White at least had some background, has been even more unsatisfactory, with White ignoring pervasive misconduct, tallying up few big cases and often siding with Republican commissioners to lighten punishment. Stein, the more blunt of the two Democrats, has repeatedly spoken publicly against the agency waiving automatic penalties for companies convicted of criminal fraud, most recently for Deutsche Bank after they pled guilty to rigging the benchmark LIBOR interest rate. “It was a complete criminal fraud upon the worldwide marketplace,” Stein said, yet Deutsche Bank was allowed to retain business lines they are supposed to lose after criminal convictions.”

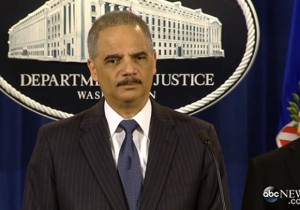

Presidents also have the power to prosecute through the FBI. But Obama chose Eric Holder as Attorney General, and Holder has built a reputation on being reluctant to prosecute important bank executives. Indeed, the so-called “Holder Doctrine” of protecting banksters who commit crimes dates back to a 1999 memo that he wrote as Deputy Attorney General in which he set out the precepts for the Holder Doctrine. Let’s see … who was President when Holder came up with that idea to not prosecute Wall Street criminals? That’s right — none other than Bill Clinton.

Presidents also have the power to prosecute through the FBI. But Obama chose Eric Holder as Attorney General, and Holder has built a reputation on being reluctant to prosecute important bank executives. Indeed, the so-called “Holder Doctrine” of protecting banksters who commit crimes dates back to a 1999 memo that he wrote as Deputy Attorney General in which he set out the precepts for the Holder Doctrine. Let’s see … who was President when Holder came up with that idea to not prosecute Wall Street criminals? That’s right — none other than Bill Clinton.

So while Bush may have given us “too big to fail” it was Clinton and Obama who gave us “too big to jail.”

When it comes to Wall Street, Bill Clinton embodied the right-leaning Democratic Leadership Council and the New Democrat Coalition — the ones who wanted to play ball with Wall Street rather than manage and regulate them. We all know that Clinton supported and pushed for Wall Street deregulation. He kept on the Ayn Rand loving Reagan appointee Alan Greenspan at the Fed. THAT should have been a red flag. Why on earth would a “progressive” Democrat want the same Fed Chairman as his supply-side ultra conservative predecessor? I will tell you why: because the DLC was pro-corporatist and pro-Big Money interests, and that is what Bernie is talking about in his ad.

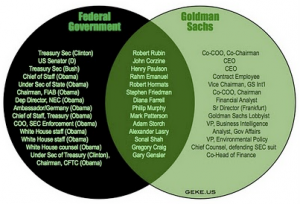

But let’s get back to Obama. To say that Obama’s taking money from Wall Street interests did not prevent him from going after those interests is pure HOOEY. The two Obama Administrations have been well-populated with Goldman Sachs executives, who come through the revolving door that has existed between the White House and Wall Street since the Clinton Administration. Indeed, the practice of putting these bankers in charge of the Treasury and other levers of government has become so routine that banks like Citi, Goldman and MorganStanley actually have career paths structured around “government service” — allowing their executives to hop over to government jobs while still making the obscene amounts of money they would have made had they stayed with the bank.

This practice of putting bankster foxes in charge of the country’s financial henhouse has flourished under Obama. Just look at the overlap between various Democratic Administrations and Goldman Sachs ALONE:

The Revolving Door of obscene and disgraceful Wall Street-White House Careers

You may not like it, but it is a fact: ever since Bill Clinton and the DLC took over, the Establishment faction of the Democratic Party has become the party of Wall Street, not Main Street.

THIS is what Bernie is talking about in his ad, and he is backing it up with a promise. In his Wall Street Address on January 5, Bernie stated clearly:

“Goldman Sachs and other Wall Street banks will not be represented in my administration.”

Voters have a choice: go with the Party Establishment, who will undoubtedly continue to place Goldman Sachs executives in positions of power within their Administrations; continue to coddle bankers and bail them out and protect them from prosecution — or you can join Bernie and support his movement to rein in and reform Wall Street and force the banks to go back to what they are supposed to do, which is to finance and support American businesses and not act solely on their own behalf to build up their own enormous wealth at the expense of the American people.

EuroYankee is a dual citizen, US-EU. He travels around Europe, writing on politics, culture and such. He pays his US taxes so he gets to weigh in on what is happening in the States.